The Colorado Senator responsible for Amendment 66 seems to be struggling with the mathematics behind the very tax hike he’s offering.

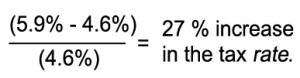

In a debate in Colorado Springs, Independence Institute* President Jon Caldara mentioned in his opening remarks that income over $75,000 a year will face an increase in the tax rate of 27%.

Just a few minutes later in the debate, Senator Johnston replied, “When you talk about the 27 percent number, you would have to make somewhere around $20-million dollars a year to be at that tax rate. So, that’s not the average Colorado earner I’m committed to.”

Watch the video:

If Amendment 66 passes, the tax rate on income over $75,000 goes from 4.6% to 5.9%

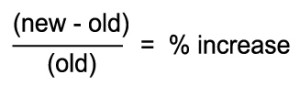

The formula for calculating percentage change can be described easily as such:

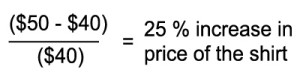

So for example, when a $40 shirt is later priced at $50, the percent increase is 25%.

Senator Johnson’s curios reply that someone would have to make $20-million leaves us perplexed. We’ve emailed Senator Johnston, but he has yet to respond to our query.

But the math is clear:

The 27% rate increase is something even Governor Hickenlooper was reluctant to admit during an appearance on 850 KOA’s The Mike Rosen Show, but the numbers are what they are as this audio from the show demonstrates:

As the Wall Street Journal noted in an op-ed, “Once a graduated tax code is in place, unions and Democrats will try again and again to raise tax rates on “the rich.” This has happened everywhere Democrats have run the show in the last decade, from Maryland to Connecticut, New York, Oregon and California. Within a decade, the top tax rate will be closer to 8% or 9%.”

Watch the full video of the Amendment 66 debate from Colorado Springs at this link. Caldara’s opening comments come at 5:21. Johnston’s remark about “the 27 percent number” starts around minute 10.

Email us tips at CompleteColorado@gmail.com

*The author of this article is employed by the Independence Institute