Special interests and their cronies in government really hate it when voters mess with their sweetheart deals. We are seeing this play out in the City of Wheat Ridge.

In the November 2015 election Wheat Ridge voters passed Initiative 300. This charter amendment says that any urban renewal plan using a tax increment financing (TIF) package of over $2.5 million must be approved by voters. Further, any TIF under $2.5 million must be approved by the elected city council rather than the appointed urban renewal authority.

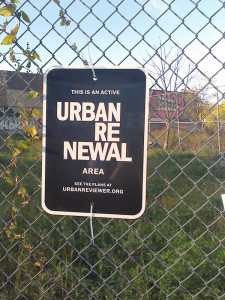

TIF is a form of corporate welfare that allows politicians and planners to reward private interests with public subsidy for preferred economic development projects within urban renewal areas (URAs). The subsidy is supposed to be paid back from the future net new, or “incremental” tax revenue from the project (this would be called speculation in the private sector). Profits from TIF-funded projects remain privatized, while any losses get spread out among taxpayers, or socialized.

Wheat Ridge 300 passed hot on the heels of a similar Measure 300 in Littleton that says any urban renewal project using TIF must first be approved by voters. The Littleton version passed overwhelmingly in March, 2015.

Voter approval for TIF is a great idea, problem is Wheat Ridge 300 was made retroactive to include an existing TIF agreement between the Wheat Ridge Urban Renewal Authority and a developer looking to build a Walmart at the corner of 38th Avenue and Wadsworth Boulevard. The proponents of 300 were quite open that the measure was introduced in large part to try and stop the Walmart-related TIF, which explains the retroactive nature of the amendment. Predictably, the developer sued over the measure, saying among other things that the retroactivity created an ex post facto (or after the fact) law, and thus violates the Colorado Constitution. And indeed, Jefferson County District Court in June granted summary judgement to the developer on the ex post facto claim, noting that “…the facts establish unconstitutional retrospectivity of Ballot Question 300 solely as it pertains to the Agreement and TIF.”![]()

Wheat Ridge for its part remained neutral on the ex post facto claim – meaning the city simply didn’t defend that part of the amendment.

Make no mistake, both the city, and the developer, wanted their TIF. But despite the court’s favorable ruling, Walmart in July went ahead and pulled out of the Wheat Ridge project.

In the meantime the rest of 300–the requirement for either voter or city council approval of new TIFs– stands, at least for now.

At the Independence Institute, we are advocates of free markets and economic liberty. If a developer wants to build in Wheat Ridge, or anywhere else for that matter, we wish them success. But we also think that voters should get to sign off on their tax dollars being used as a corporate welfare incentive.

The lesson here is activists looking to run a version of Initiative 300 in their own city shouldn’t wait for a controversial project to come along. Instead, do it because it’s a great way to take back some control over your local government and your hard earned tax dollars.

Mike Krause is the Director of the Local Colorado Project at the Independence Institute, a free market think tank in Denver.