The progressive onslaught continues at the state Capitol, thrilling social justice junkies while terrifying those of us who remember when Colorado kept government somewhat constrained.

A red flag bill which puts the burden of proof on the accused to get guns back that have been confiscated. Statewide oil and gas regulations that would make crazed Boulder City Council members climax. Teaching kids how to have healthy transsexual relationships. Changing genders on birth certificates like changing your mailing address. National Popular Vote so Los Angeles can control our electors. Forfeiting our automobile regulations to the governor of California.

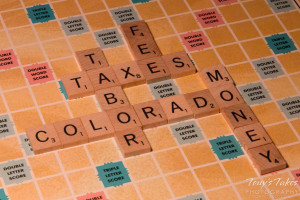

The next lurch towards the promise of “democratic socialism” is Senate Bill 188, warmly titled “FAMLI.” Get it? “Family.” If Focus on the Family titled a bill that, the left would be nauseated. But this “family” is a massive tax increase for a government-run family leave program.

We can talk about why this particular scheme is reckless later, but for the sake of argument let’s assume it’s just peachy. Then there’s only one teensy issue. It violates our state constitution.

It raises your payroll tax by about a billion dollars a year without first asking you as required by our Taxpayer’s Bill of Rights.

This bill will say much more about the Colorado Supreme Court than it will the legislature, which has already proven they’ll transform us into Venezuela when given half the chance.

Over the last 25 years our Court hasn’t missed an opportunity to weaken TABOR to the point where it is an emaciated weakling of what it once was.

Our Taxpayer’s Bill of Rights says a government can keep excess tax revenue, above the limit of population growth and inflation, without refunding it. All it has to do is ask for our consent. TABOR says it can do that for four years. Our Supreme Court ruled that “four years” shall read as “forever,” I guess because it sounds kind of the same. Now 80 percent of all Colorado cities, since they asked just once, will never refund your excess taxes back to you, ever.

Our Taxpayer’s Bill of Rights says our elected representatives can raise all the debt they desire. All they have to do is ask our consent first. But our Supreme Court ruled that if they call debt a “Certificate of Participation” (COP) they need never ask. Instead of![]() a debt package with say a 20-year term, a COP is 20 one-year loans in a row. In other words, the same thing.

a debt package with say a 20-year term, a COP is 20 one-year loans in a row. In other words, the same thing.

Our Taxpayer’s Bill of Rights says they can raise taxes as much as they crave. All they have to do is ask our consent first. But our Supreme Court ruled that if they call it a “fee,” well you get the idea.

Should SB 188 become law it will be challenged in court as a violation of our Taxpayer’s Bill of Rights. If history is any indication our Supreme Court should rule it’s dandy to call it a “fee.”

But unlike plastic bag “fees,” or the mill levy freeze, or the Faster “fee” on our car registrations, or the Hospital Provider “fee,” this payroll tax will be very public and understandable.

Every employed Coloradan will comprehend that their payroll tax just went up by 0.32 percent (for the first two years, and then who knows after that). And they’ll be reminded it’s a tax every payday. It will be right there on their pay stub next to their income tax withholding, Social Security tax, Medicare tax, etc.

There is little transparency in most of the tax increases the Supreme Court allowed to be called a “fee.” Your car registration tax happens only once a year. Bag taxes get lost in your grocery receipt. Your property taxes get mixed in with house payment, and those who rent get mad at landlords for raising the rent, not the legislature for causing it. And, get this insult, the law prohibits the Hospital Tax from being listed on your hospital bill. Classy, huh?

If the court actually reads the Constitution instead of rewriting it, they’ll declare FAMLI a tax, then great. If not, it might be the spark needed for voters to rebuild our Taxpayer’s Bill of Right back to what they voted for in the first place.

Why does asking voters for tax increases repulse so many inside government? They don’t want to risk being told “no.”

Jon Caldara is president of the Independence Institute, a free market think tank in Denver.