WHEAT RIDGE—A Colorado city is now home to the tip of the spear in combating China’s domination of the world-market for rare earth elements (REE). Manipulation of the REE market by China most recently resulted in the shutdown of the Mountain Pass REE mine in California in 2015 after an attempt by Greenwood Village-based Molycorp to reopen what has been the only developed REE mine in the U.S.

A pilot plant, now in operation in Wheat Ridge, which borders Denver to the west, will fine-tune existing technology to extract and purify elements including lithium, scandium, zirconium, beryllium, gallium and hafnium, among others, from domestic ore deposits in Texas.

The plant, built by New York-based USA Rare Earth (USARE) and commissioned June 11, was built to be near the expertise at the Colorado School of Mines in Golden, adjacent to Wheat Ridge, during the technology development phase. USARE expects to build a larger plant starting in 2021 at the Round Top REE mine the company is developing near El Paso, Texas.

In a company press release, Pini Althaus, CEO of USARE said, “Our Colorado pilot plant will be the first processing facility outside of China with the ability to separate the full range of rare earths – Lights, Mids and Heavies. Our Wheat Ridge pilot plant is the second piece of a 100% U.S.-based rare earth oxide supply chain, drawing on feedstock from our Round Top heavy rare earth and critical minerals deposit in southwest Texas. Taken together, Round Top and our pilot plant constitute essential links in restoring a domestic U.S. rare earth supply chain, extracting rare earths and processing them into individual REE oxides – without the material ever leaving the United States, thereby alleviating the current dependence on China for the both raw materials and mineral processing.”

The Wheat Ridge pilot plant may remain active after the new plant is built in Texas to process ore from other mines.

There are several large REE ore bodies in the US and Canada that remain undeveloped.

Since China first started developing its internal REE mining and refining capacity in the 1950s, it has grown to control as much as 99% of the market for these elements, which are indispensable for the production of advanced electronics, permanent magnets and military hardware.

The F-35 Joint Strike Fighter uses some 920 pounds of rare earth metals, and Virginian-class nuclear submarines use nearly 10 tons.

Rare earth metals are also needed for consumer products like hybrid cars, laptop computers and mobile phones.

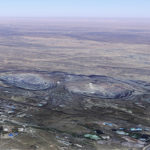

The U.S. has several known deposits of REE, including in California, Alaska and Texas, that have been languishing in the face of China’s market domination.

President Trump issued an Executive Order on December 20, 2017 directing the government to facilitate development of strategic minerals supplies, including REE, saying, “This dependency of the United States on foreign sources creates a strategic vulnerability for both its economy and military to adverse foreign government action, natural disaster, and other events that can disrupt supply of these key minerals.”

There are no facilities for refining REE ores in the United States, and only one other plant outside of China. This means that almost all REE ore mined anywhere in the world must go to China or Malaysia to be refined into pure usable stock.

Since 2017 the U.S. government has been buying REE from an Australian firm, Lynas Corp., which mines REE in Western Australia and refines it at its processing plant in Malaysia.

But according to author Robert Castellano, writing in the online financial publication Seeking Alpha, “U.S. Senator Ted Cruz and five other senators sent a letter to the Pentagon pushing it to only fund U.S. rare earth projects.”

China has long sought to control access to refining facilities to favor their own enormous Biayun Obo rare earth mine located in Inner Mongolia, that contains perhaps 70% of the world’s known REE reserves.

Reuters reported on May 13, 2020, “U.S. Senator Ted Cruz introduced legislation on Tuesday to help revive the U.S. rare earths industry with tax breaks for mine developers and manufacturers who buy their products, the latest attempt by Washington to break China’s control over the strategic sector.”

Editors’s Note: An error in attributing Chinese minority ownership of Lynas has been corrected to reflect the source of the information and provide a direct quote from the source author, Robert Castellano.

Pingback: News of the Week (July 5th, 2020) | The Political Hat

Pingback: The American Kestrel