UPDATE: City Council settles on an added $21.99 per month for the next 14 months on utility bills to pay for exorbitantly priced natural gas purchased during the February cold snap.

COLORADO SPRINGS–Thanks to the Valentines Day deep freeze that plunged Colorado and the central U.S. to below-zero temperatures extending as far south as Texas, Colorado Springs Utilities (CSU) blew this year’s natural gas budget buying high-priced gas to meet the demand. The Colorado Springs City Council is considering how customers will pay for the massive overage at Monday’s work session and will hold a public hearing and vote on the matter Tuesday, March 9 at about 1 p.m. Details can be found here.

From February 13, the day before the storm, through February 19 CSU spent $86.3 million buying an extra 549,900 dekatherms (Dth), each equal to 1 million BTUs of natural gas, at an average of $156.94 per Dth, over and above what CSU had prior contracts for.

Because CSU is a city enterprise, it cannot get more than 10% of its funding from government. This means the city can’t bail CSU out, so ratepayers will have to.

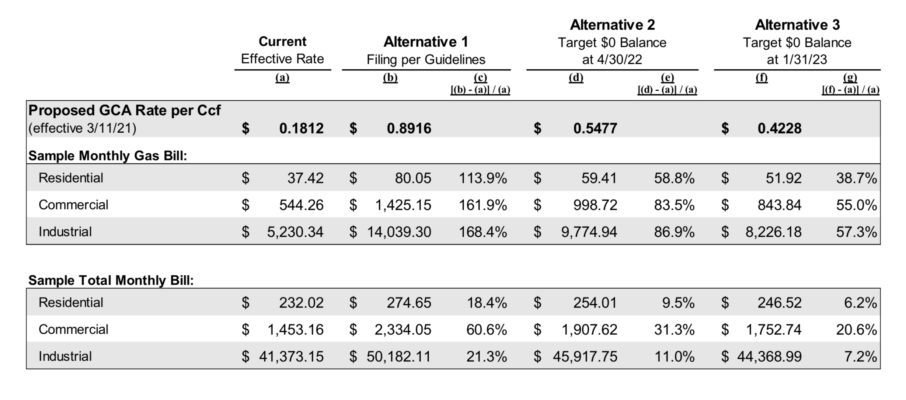

Payment options being considered for monthly residential rates include a 113.9% increase, a 58.8% increase through April 30, 2022 and a 38.7% increase through January 31, 2023. Commercial and industrial rates could be as much as 168.4% higher.

On Saturday, February 13 meteorologists nationwide were urgently warning of the onset of temperatures as low as -40 in the upper tier of Midwestern states and below-freezing temperatures by Sunday as far south as the Gulf of Mexico along the coast of Texas.

Colorado Springs did not escape the impact of the storm and dropped to a low of -12 degrees that broke the previous -9 degree record set in 1895.

As the deep cold set in, Texas became a microcosm of everything that could go wrong with a power grid.

Extremely low temperatures and the lack of proper insulation of critical infrastructure caused water lines in coal-fired and nuclear power plants to freeze, shutting them down. Moisture in natural gas caused icing of valves, control sensors and delivery lines, causing low pressure and shortages of gas to run its gas-fired plants.

The storm caused at least 85 deaths, grid failure and rolling blackouts in Texas as regulators struggled to manage the enormous jump in demand for both electricity and natural gas for heating.

In the rest of the affected states, including Colorado, record demand for natural gas caused shortages and spikes in gas prices from the pre-freeze rate of about $3 per dekatherm (Dth).

Although Colorado avoided blackouts and fatal shortages of gas for heating, Xcel Energy, Colorado’s largest power provider claims it incurred some $650 million in excess natural gas costs for Colorado alone when wholesale prices in the region spiked 95 times higher than the normal $2 to $3 to $600 per Dth.

Each of Xcel’s 2.9 million Colorado customers may have to pay an additional $264 to cover Xcel’s costs. Spread over two years, the standard Xcel practice, ratepayers might see an additional $3.50 to $7.50 per month on their bills.

More than 78% of natural gas in Colorado Springs is for residential, commercial and industrial use, while just under 22% is used by the city’s Front Range and Nixon gas-fired power plants.

The city’s two coal-fired power plants, Martin Drake and Ray Nixon, have a combined nameplate capacity of 415 MW. During the cold snap both coal plants were operating.

CSU reports a record setting total one-day load on the city’s grid of 16,621 megawatt hours (MWh), surpassing the February 1, 2011 record of 16,593 MWh.

CSU said in a blog post, “We brought Martin Drake Power Plant out of a scheduled outage last Wednesday, Feb. 10. This gave us more flexibility and allowed us to run on coal and not natural gas, which is still very expensive.”

From February 13 to 19 the Martin Drake plant consumed 8,030 tons of coal and the Ray Nixon plant consumed 19,600 tons.

The two coal plants produced 522,207 Dth of energy, slightly less than the amount of natural gas CSU had to buy at inflated prices, but it was produced with coal already stockpiled at the plants purchased long before the cold snap.

According to CSU, fossil fuels provided 93.53% of the power used for the week. Solar and wind combined produced 5.48%, with hydro power providing the remaining 1.17%.

CSU declined to provide data on how many MWh of electricity were produced by each of the city’s four fossil-fuel power plants during the cold snap, citing confidentiality.

The problem with using natural gas instead of coal to run power plants is that power plants compete with residential, commercial and industrial uses for natural gas, whereas coal is almost exclusively used to provide the nation’s electric power.

There is less market competition for coal, and its delivery system is slow enough that many plants keep at least a 30-day stockpile of coal on hand at all times. While it may be somewhat more expensive, coal is more reliable and far less subject to sudden price spikes caused by shortages like this one.

The Martin Drake plant is scheduled to be decommissioned in 2023 in a process accelerated from 2030 in June of last year by the CSU Board of Directors, which also happens to be the City Council. CSU is also planning to shutter the Ray Nixon plant by 2030.

Pingback: City Council Should NOT Manage the Colorado Springs Utilities |