Jefferson County is one of more than a dozen counties in Colorado that is still enjoys the protections of government revenue caps under the state’s Taxpayer’s Bill of Rights (TABOR) amendment. In years of excess revenue collection, the taxpayers traditionally benefit from this TABOR feature by a temporary property tax reduction. Unfortunately, County Commissioners Lesley Dahlkemper, Andy Kerr, and Tracy Kraft-Tharp didn’t want to issue the 2020 refunds in an efficient way, instead, they chose to spend $200,000 in postage to send $1.5 million dollars in rebate checks to residents.

The commissioners chose to unnecessarily spend that money so that they could then introduce a recently concluded promotional tour gauging feedback on whether they would be successful in eliminating all or parts of the TABOR revenue caps. County voters decidedly said no to a similar effort in 2019. In addition, they are polling meeting participants about an alternative sales tax increase.

The problem is that those who have read the county promotional literature and attended the meetings haven’t been given all the facts.

Millions from COVID Relief

Due to government-mandated COVID shutdowns, tax revenue was less than expected, so Congress issued COVID relief money to local governments like Jefferson County. One of the permissible uses was to counteract impact of revenue loss to local governments.

In 2020, Jefferson County received $101.7 million in federal relief funds as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act. Some of those dollars were redistributed to other governments, while Jefferson County retained $50.2 million.

Through the American Rescue Plan Act (ARPA) package, Jefferson County received $56.6M in 2021, and an additional $56.6M is scheduled to be received in June 2022, for a combined total $113.2M in federal funding.

The total retained by the county is close to $163.4 million between CARES and ARPA funds.

Who got the bucks?

Millions of grant dollars were handed out in 2020 by the county to private and non-profit entities. It’s unclear how much was handed out in 2021, as the check register for that year has not yet been published for unknown reasons.

Unlike many other local governments, county officials only recently came to the realization that COVID money could be used to cover revenue loss to the county itself. I have firsthand experience with this as I was serving as a board director on the Regional Transportation District (RTD) when the CARES money started to pour in. RTD used it for operations and maintenance expenses, even though reduced ridership drops didn’t justify maintaining the same service levels. The point is that using federal COVID money for payroll and administrative expenses, even retroactively, was well known among government agencies.

So is there a game plan here that voters aren’t privy to and county commissioners are? It’s not hard to believe that’s the case as Jefferson County Commissioner Andy Kerr was the lead named plaintiff in the infamous 10-year legal battle to overturn the Taxpayer’s Bill of Rights–which was recently dismissed in federal court–and neither of the other two commissioners have publicly expressed any love for TABOR.

From a skeptical view, it appears the county is hosting a lot of meetings but not talking about the millions of dollars in COVID money. Meeting attendees are polled but only been given part of the financial story. That isn’t a healthy way to have a community discussion and certainly contaminates survey results.

There’s another odd piece going on here. Jefferson County Sheriff Jeff Shrader recently posted a social media message asking the public to pressure the county commissioners into allocating $3.75 million to the sheriff’s 2023 budget. The $3.75 million had been previously earmarked for hiring replacement jail employees, but due to a shortage of applicants that is taking longer than planned and now the money is proposed to move elsewhere.

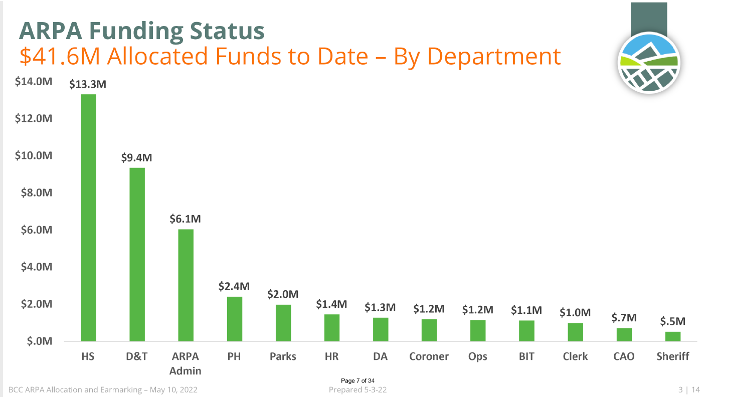

Shrader indicates that just $260,000 has been issued to his office. The latest allocation recommendation indicates a little more may eventually be distributed, bringing the total to $530,000. That’s 0.32% out of the $163.4 million pot of COVID relief money. Jefferson County is responding to emails now with a message that the commissioners take public safety very seriously but haven’t yet made a decision. Reviewing this graph shot of initial allocations, it’s a bit challenging hard to see that the Shrader’s office has been given serious attention, especially in light of increased crime rates.

Jefferson County has $116.4 million left to spend from CARES and ARPA, plus, more funds are expected from the Infrastructure bill.

Now that the county knows they can use the millions in carryover CARES, plus the ARPA funds for revenue shortfalls, the discussion about eliminating or suspending a portion of the Taxpayer’s Bill of Rights should be withdrawn.

Natalie Menten, a Jefferson County resident, is a longtime activist and former elected RTD director