LAKEWOOD — A Colorado State Senate candidate has added her name to a long list of Democrats trying to take credit for this year’s Taxpayer’s Bill of Rights (TABOR) refunds, despite a history of trying to eliminate the constitutionally required return of overcollected tax revenue.

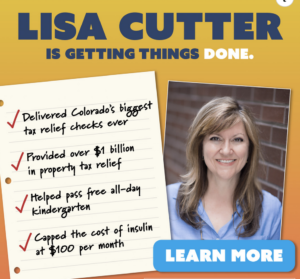

Lisa Cutter, who until this year has represented House District 25 and served as the House Majority Caucus Co-Chair, is featured in a social media ad telling voters she was responsible for the refund checks that recently went out to Coloradans, that are actually the result of TABOR, an amendment to the Colorado Constitution that limits the state from raising taxes or exceeding a revenue limit on a portion of the state budget without first asking voters. The ad, which links back to Cutter’s campaign website, makes no mention of TABOR, instead claiming she “Delivered Colorado’s biggest tax relief checks ever.”

Cutter is competing against Republican Tim Walsh for Senate District 20 In Jefferson County, a seat left open by Brittany Pettersen, who is running to replace Rep. Ed Perlmutter, who decided not to run for re-election to Congress.

Cutter’s history against TABOR

Although voters have repeatedly defeated attempts to dismantle TABOR, Democrats — including Cutter– have been trying to do just that, most recently with Proposition CC in 2019, which would have eliminated TABOR refunds, allowing the legislature to keep and spend that excess revenue in perpetuity instead. Colorado voters handily defeated the measure at the ballot.

In fact, Cutter not only supported Prop CC, she was also a co-sponsor on the bill that referred the measure to the voters.

“Are you ready to vote yes on Prop CC,” Cutter said in a Tweet on Oct. 16, 2019, campaigning for a “yes” vote. A few days later she Tweeted out an editorial by the left-leaning Aurora Sentinel.

In that editorial, the Sentinel says the man behind TABOR, Douglas Bruce “and other fringe anti-tax proponents have long billed TABOR as a panacea for limited government. It’s not. It’s a sham.” Cutter hailed the editorial as a “a great explanation of what TABOR has done to Colorado.”

Embracing TABOR in an election year

Yet, in a year where Democrats are being blamed for everything from the highest inflation in state history and the ever-growing crime rates to parent dissatisfaction with educational opportunities and dozens of new fees and taxes, Cutter, like many of her colleagues, has embraced the TABOR refunds to win over voters.

In an opinion piece for the Jeffco Transcript, Cutter wrote:

“Coloradans who filed their taxes by June 30, 2022, can expect to receive their Colorado Cashback check in the mail beginning this August,” Cutter said. “These expedited checks are intended to help ease some financial burden, support your families, and help pay for things like gas, groceries and rent.”

Nowhere in the opinion piece, co-authored with Sen. Tammy Story and Sen. Jessie Danielson, did the women explain to voters these checks were actually constitutionally-mandated TABOR refunds — not special refunds at the hands of Democrats.

The great rebranding

In years where revenue exceeds TABOR limits, the state must either refund the money to taxpayers or ask voters to allow the state to keep it. The process has been in place for decades.

Democrats, however, wrote legislation that moved up the disbursement date so that the refunds arrived more than six months early, as they are based on revenue projections for the 2022/23 fiscal year and otherwise would not have been distributed until after 2022 tax returns were processed.

They also changed the calculation for how much Coloradans would receive.

Colorado’s fiscal year runs from July 1 through June 30. At the end of each fiscal year, the state predicts what the revenue will look like for the following fiscal year. If the revenue is expected to exceed the limits, taxpayers will get a refund on that tax return.

For example, excess revenue for fiscal year 2020/2021 was refunded on the 2021 income tax return based on filing status and tax liability. Additionally, there are six tiers of income level that determine how much the taxpayer receives.

The key word here is “taxpayers.” Prior to this year, TABOR refunds were distributed only to taxpayers who had a liability on their income tax return. However, for the next two years anyone who files by June 30 will get a check, regardless of whether taxes are owed.

Finally, they rebranded it the “Colorado Cashback,” a term that has angered Republicans who have supported TABOR since its passage.

Republican Senator Barbara Kirkmeyer who is running for the new U.S. Congressional District 8 seat was accused of “withholding essential cash from working Coloradans” by her opponent, State Rep. Yadira Caraveo because she voted no on the bill.

Kirkmeyer responded by saying the rebranding effort is disingenuous.

“They came up with this to make it look like they were giving people a stimulus check,” Kirkmeyer told Complete Colorado in a previous story. “In no way did I vote to ‘withhold essential cash’ from working Coloradans. I also voted against all those tax increases my opponent voted for. The Dems all act like they are doing us a favor. I’m surprised they didn’t just put the check in with the mail-in ballots. They are just trying to buy votes.”