Groups that depend on state tax money for their existence tend to claim that Coloradans are undertaxed.

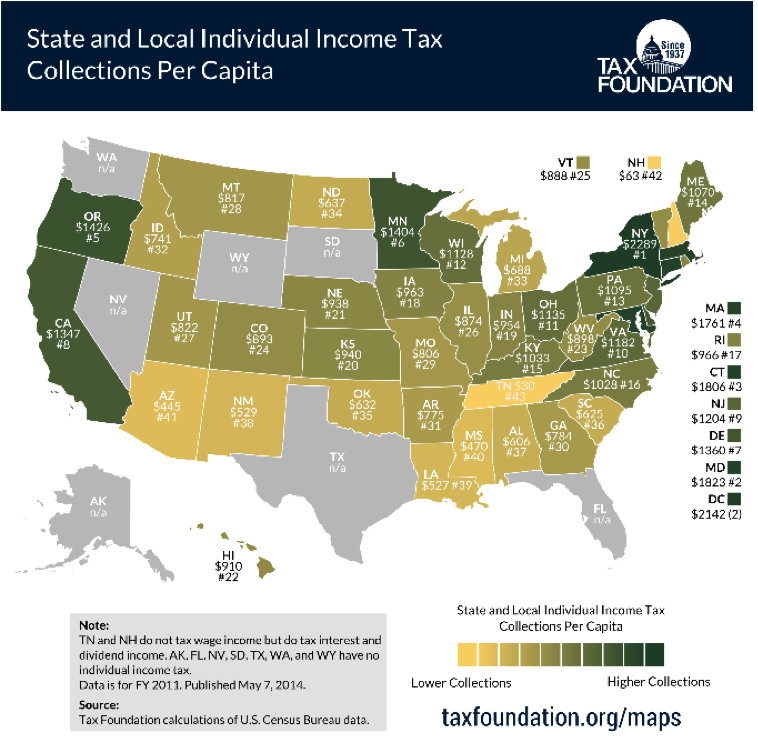

In a new release, the Tax Foundation calculates that Colorado was 24th in the amount of state and local individual income tax collections per capita. Colorado isn’t yet New York, Maryland, Connecticut, or Massachusetts, but it isn’t Utah, either. According to a 2013 Gallup poll, 41 percent of the people in New York, 47 percent of the people in Maryland, 49 percent of the people in Connecticut, and 41 percent of the people in Massachusetts want to move to another state. Just 25 percent of the people in Colorado want to move.

Income taxes are only part of the story, of course, and Colorado ranked a more reasonable 32nd in the Tax Foundation’s 2011 estimate of total per capita tax burden.

People flee when state governments get too greedy. New York, the per capita state tax burden leader since at least 1977, lost 1.6 million people between 2000 and 2010. This was the equivalent of 8.27 percent of its 2000 population.

The 1.6 million who left included almost 1.2 million taxpayers. According to the IRS, the average adjusted gross income of taxpayers leaving New York was $58,899. The average adjusted gross income of those moving in was $48,432. The Empire Center estimates that New York’s net annual income loss from the out-migration was $37 billion.

Linda Gorman is an economist at the Independence Institute, a free market think tank in Denver.